Using step costs

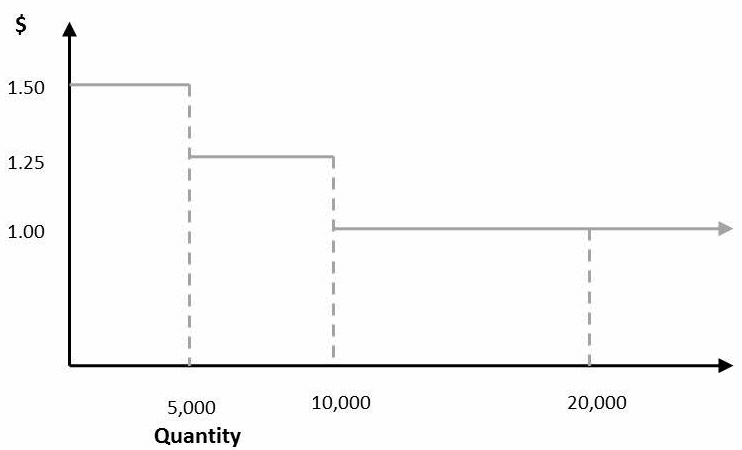

You can use step costs to set up cost lookups based on pairs of values representing the step and associated cost. For example, you may have a throughput step cost where the cost varies based on the throughput quantity. Throughput less than 200 units is 1.5 per unit, greater than or equal to 200 and less than 500 is 1.25 and greater than or equal to 500 is 1.0.

You define step costs in the following tables:

- Step Cost Definitions – Use this table to define the step period and basis for the step cost.

- Step Costs – Use this table to define minimum throughput-cost pairs for the step cost definition.

Each step function is identified by a name. You create a record for each step interval, including the units in which that step is defined. Using the transportation policy cost example, you may have a Step Cost Definition such as:

| Name | Type | Step Basis | Step Type | Step Period |

| TPCostRegion1 | Variable Transportation Cost | Quantity | Incremental | Period Length |

You then define associated Step Costs, such as:

| Name | Minimum Quantity | Cost |

| TPCostRegion1 | 0 | 1.50 |

| TPCostRegion1 | 5000 | 1.25 |

| TPCostRegion1 | 10000 | 1.00 |

You can also enter step costs directly in the target column where the step cost takes the format:

<step1|value1><step2|value2>...<stepn|valuen>

From the transportation example above, this would be entered as:

<0|1.50><5000|1.25><10000|1.00>

Incremental and All Item discounts

There are two methods to determining step costs:

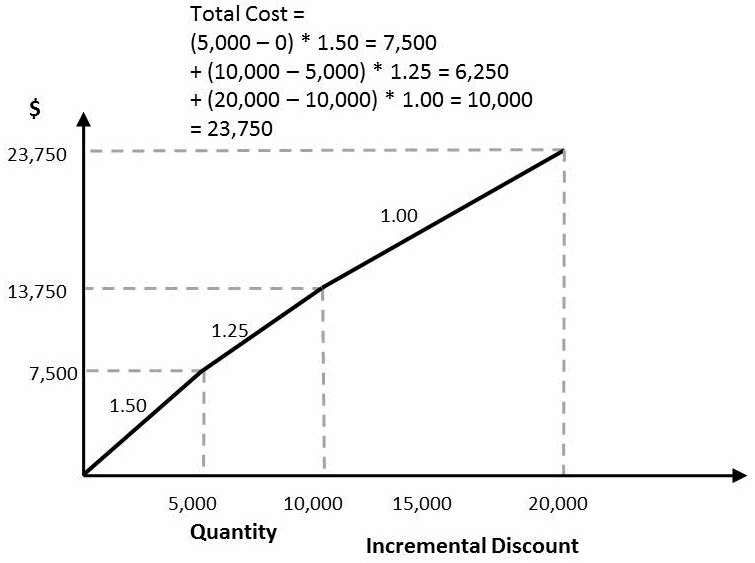

- Incremental – With this method (the default), step costs are calculated based on quantity break points. For example, assume you have set up the Variable Transportation Cost as in the table above and there is flow of 20,000 units. The total cost will be:

- (5,000 - 0) * 1.50 + (10,000 - 5,000) * 1.25 + (20,000 - 10,000) * 1.00 = 23,750

- That is, the first 5,000 units (the first cost break) will have a cost of 1.50 each, the cost per unit for the second step (5,000 to 10,000 units) will be 1.25 and those units from 10,000 to 20,000 will be 1.00 each.

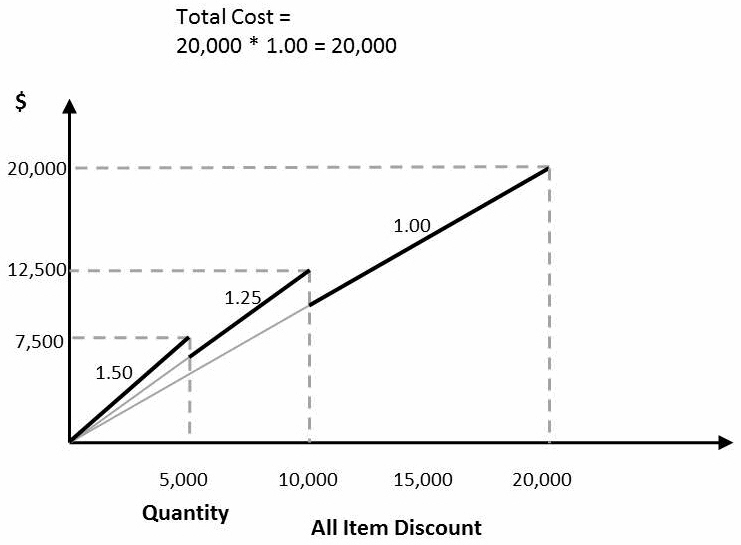

- All Item – With this method, the cost is based on the break in which the total quantity occurs. Given the same example from above, Variable Transportation Cost as in the table above and a flow of 20,000 units, the total cost will be:

- 20,000 * 1.0 = 20,000

Using the example above, the cost for each quantity break is:

When using incremental discounts, the quantity within each quantity break is costed:

When using all item discounts, the cost is based on the break in which the total quantity occurs. In this case, anything greater than 10,000 has a cost of 1.00 per quantity unit:

Last modified: Friday May 12, 2023