Financial modeling

Fixed operating costs are used to cost different levels of operation within a site which can be cheaper or more expensive based on a certain throughput level. However, there are cases where a capital investment is needed to permanently expand a site. Also, if you are considering multiple facilities or work centers to be opened or expanded, you may want to put a maximum investment constraint on the sum of capital investments. Providing a separate mechanism to record and constrain capital investments reflects different budgets for operating the business and making capital investments.

For financial reporting, companies take depreciation into account and often report EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). The model database includes fields to record book value and depreciation for new and existing facilities and work centers. Output table columns reflect the depreciation and book value.

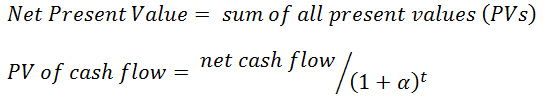

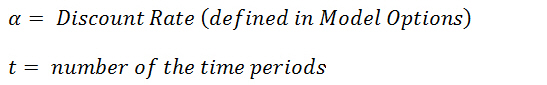

Net Present Value (the time value of money) is part of the objective function and is applied to all costs. This value is determined as shown below:

where:

Last modified: Wednesday May 15, 2024